Laxmi Organic Industries Limited IPO Official Details and Subscribe or Avoid

Business: Laxmi Organics Industries LTD

Laxmi Organic Industries is a speciality chemical manufacturer, focused on two key business segments:

Acetyl Intermediates (AI) and speciality Intermediates (SI)

Laxmi was set up nearly three decades ago with the objective of manufacturing alcohol-based chemicals. In early days, Company focused primarily on the production of bulk chemicals. Subsequently, progressed up the value chain and started producing ethanol downstreams and pioneered the manufacturing of solvents in India. Due to high standards in quality and meticulous focus on customer satisfaction, Company became the one of the preferred partners of choice of pharmaceutical companies and ink manufacturers. In the past decade, Company have expanded our capabilities to speciality intermediates. The addition of Diketene to product portfolio has solidified our position as a leading manufacturer of fine and speciality chemicals in the country.

In the coming years, Company aim to establish ourselves as a leader in speciality intermediates and become the growth partner of choice to global

Life Sciences, Crop Sciences and Pigments companies.

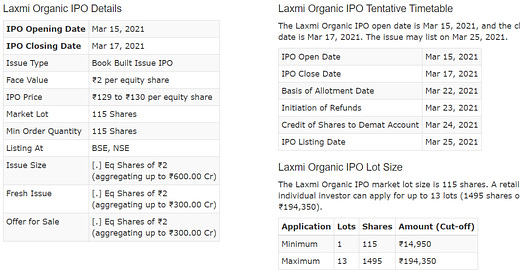

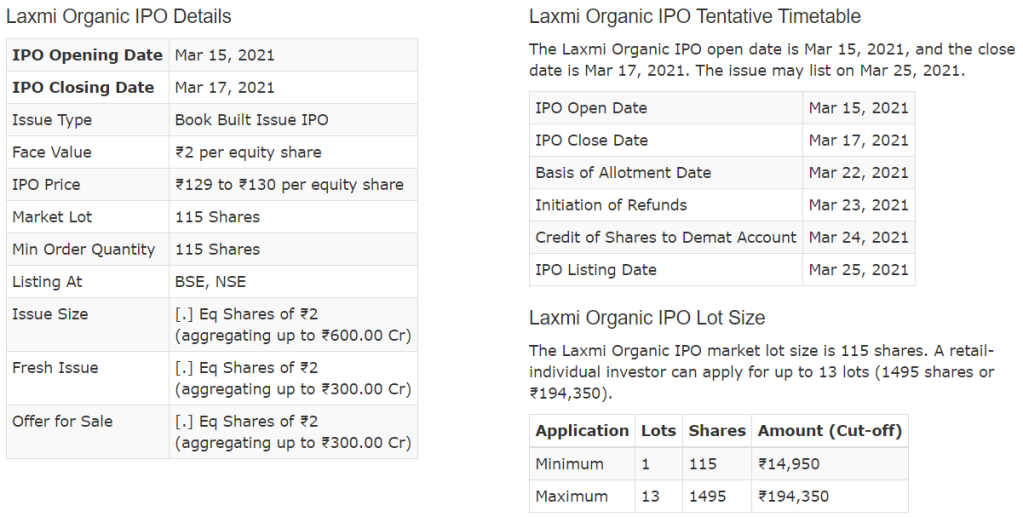

IPO Detail and Timelines:

Key Strengths:

Leading manufacturer of acetyl and specialty intermediates and the largest manufacturers of ethyl acetate in India with a market share of approximately 30%.

The company is the only manufacturer of diketene derivatives in India.

Marquee customers like Alembic Pharmaceuticals, Dr Reddy’s Laboratories, Laurus Labs, Neuland Laboratories, Suven Pharmaceuticals, UPL.

Experienced promoter and board of directors.

strong presence in 30 countries including USA, UK, China, Russia.

Key Risks:

Major income dependent on Acetyl intermediates.

Future plans:

Trying to increasing capacity utilization for acetyl intermediates production to 76%.

Maximizing the production volume at their manufacturing units.

Diversify existing product portfolio by adding new products.

Financials:

Steady in terms of Total Revenue and Total Asset.

PAT is affected due to large amount in depreciation and amortization.

3. Company P/E is around 37.86, looks to be decent as compared to competitors.

I have written as separate article 'To maximize the chance for getting allotments in IPO', Must read before applying the IPO.

How to maximize your chances to get IPO allotment – Ambrulz's Blog (wordpress.com)

<Subscribe or Avoid>

Short Term / Listing Gains: Apply for listing gain and short term gain.

Gray Market Premium(heard): Rs 85- as of 13th March 2021.

Long Term: Can hold for long term with the view points of 3 years and so.

Happy Investing:-)